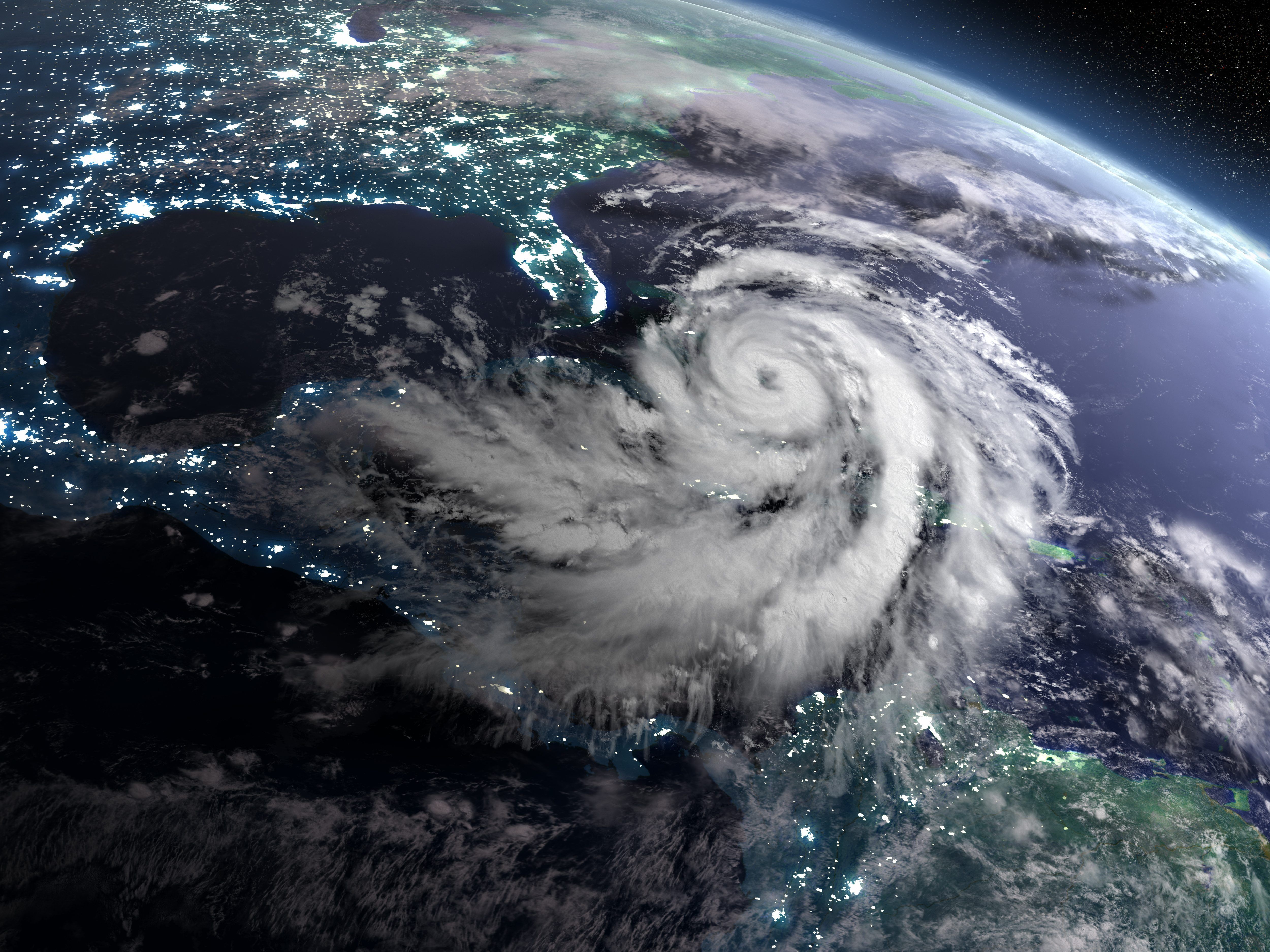

Two weeks ago today, Hurricane Irma tore through in Southwest Florida. All things considered, it could have certainly been much worse. However, it was as bad as it gets for those who lost their lives, and some communities suffered relatively substantial property damage. So, over the next several weeks, this column will focus on legal issues commonly confronted by associations dealing with disaster recovery.

Most associations do not have sufficient cash on hand to meet immediate post-disaster needs. In my opinion, restricted reserves should not be used without an owner vote. There are several options that are available, including lines of credit and advances from insurers. Under no circumstances should an association finance any kind of work by assigning insurance policy rights to a vendor.

For condominium associations, there may be the ability to use special assessments to get some additional insurance contributions, albeit in a roundabout way. Section 718.111(11)(g) of the Florida Condominium Act states that “a condominium unit owner policy must conform to the requirements of Section 627.714.”

Section 627.714 of the Florida Statutes provides that every condominium unit owner’s insurance policy, commonly referred to as the “HO-6” policy “must include at least $2,000 in property loss assessment coverage for all assessments made as a result of the same direct loss to the property, regardless of the number of assessments, owned by all members of the association collectively if such loss is of the type of loss covered by the unit owner’s residential property insurance policy, to which a deductible of no more than $250 per direct property loss applies. If a deductible was or will be applied to other property loss sustained by the unit owner resulting from the same direct loss to the property, no deductible applies to the loss assessment coverage.”

While HO-6 insurance is no longer mandatory for condo unit owners in Florida, my experience has been that the vast majority of unit owners carry it. So, simply stated, an association can get some of the funds necessary for certain aspects of hurricane damage from the unit owners’ insurance companies, by levying a special assessment and then having the owners turn to their private insurers for reimbursement.

Such assessments should not be imposed without the guidance of legal counsel, as there are some technicalities involved, and the nature and extent of your community’s damage may play a role, as well.

Further, given that a state of emergency was declared, the “emergency powers” granted to boards in Section 718.1265 of the Florida Condominium Act are applicable. Among other extraordinary powers granted to boards, this law states that regardless of any provision to the contrary and even if such authority does not specifically appear in the declaration of condominium, articles, or bylaws of the association, the board of directors may levy special assessments without a vote of the owners. Whether the board can skip the statutorily required 14-day notice requirement under the emergency exception in the statute will depend on the severity of the damage and other factors.

Next week, I will pass on some tips to avoid making your hurricane damage repair project a bigger disaster than the storm itself, a situation I saw over and over after the 2004-05 hurricanes. One quick and perhaps obvious tip: Don’t feel pressured to sign contracts involving significant expenditures or undertakings without proper review, including asking your attorney to look them over. While there are many reputable vendors who specialize in post-disaster services, there are unfortunately charlatans who show up after these events. Remember, the term “con man” derives from the word confidence, so you probably won’t see it coming. There are attorneys, engineers, managers, and insurance professionals who have done business in your community for years, and aren’t just here for the quick buck. People sometimes forget that when they are in a state of panic, and that is not a good place to be when making decisions that affect one of your most significant investments, not to mention the investment of your neighbors to whom board members owe a fiduciary duty.

Joe Adams is an attorney with Becker & Poliakoff, P.A., Fort Myers. Send questions to Joe Adams by e-mail to jadams@bplegal.com. Past editions may be viewed at floridacondohoalawblog.com

ActAssessmentDamagesDeductibleDisasterEmergencyExpendituresFundsHurricaneIrmaIssuesLossOwnersPolicyPost-disasterPropertyRecoveryReimbursementRepairsStatutes